Wall Street's Dangerous Word Games

People don't get rich by having "exposure," they die from it.

Have you ever noticed how financial advisors talk about "exposure to the market" as if it's something desirable? In almost every other context, exposure is something we actively avoid. People literally die from exposure to the elements. Shelter—protection from exposure—is the first layer of Maslow's hierarchy of needs!

Yet somehow, in the world of financial planning, we're told to embrace "exposure" and "risk" as though they are the tickets to prosperity.

It rings like Orwellian “Newspeak” in my ears, and the reality is that it has trapped many, many hardworking Americans in a cycle of financial vulnerability.

Are these words used this way on purpose?

If you've ever felt confused or disappointed by your financial progress, know this: it's not because you lack financial acumen. The system is designed to keep you in the dark.

The traditional financial industry has conditioned us to accept a fundamentally flawed equation: that high risk automatically equals high return. There is zero correlation between high risk and high return. What they call "risk" is actually just the "probability of loss"—something any rational person would want to minimize, not embrace.

I think most people know this at a gut level, but they ignore it because there isn’t any other information saying anything different out there.

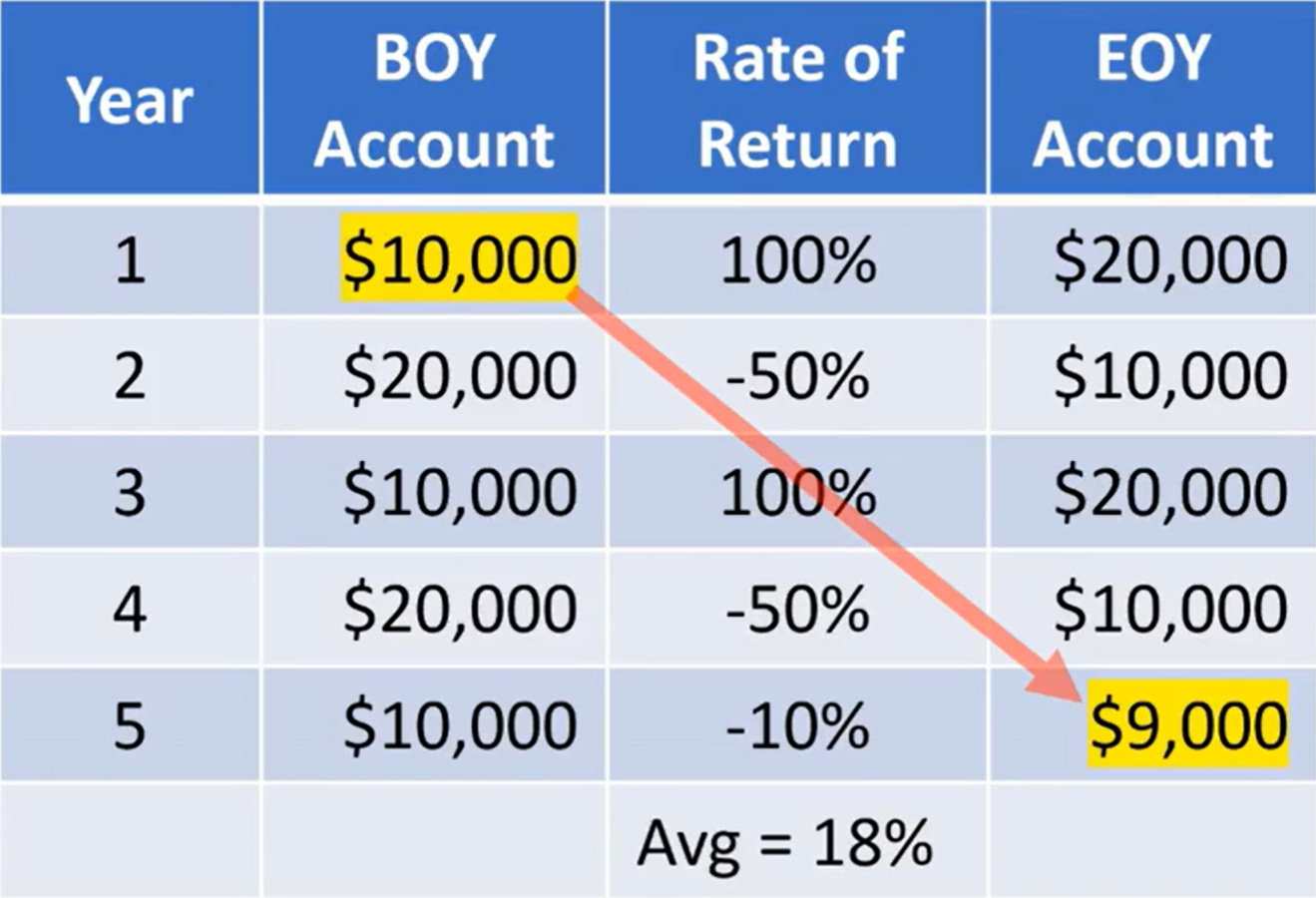

You've been told that "as long as you invest for the long term, you're going to be all right" and achieve a high "average rate of return." But here's what they don't tell you: Average rates of return don't really mean anything. You can have a positive average return and still lose money:

Why You Shouldn't Fear Missing Out

One of the most powerful weapons in the traditional financial advisor's arsenal is fear—specifically, the fear of missing out on market gains. It’s crazy if you think about it because if you cut through the fluff, it’s the only tool in their toolbelt: the hope of a good return. They've created an environment where investors feel there's never a good time to sell. You're afraid to miss potential gains, but you're also scared of losing what you have.

This fear is only a problem if you don't have a plan. And that's what you’re told you’ll get when working with a financial planner. In doing so, however, you will not get a clear, controlled plan that works regardless of market conditions. You’ll get what you get.

Let me reassure you: You can build wealth without subjecting yourself to the whims of unpredictable markets. The anxiety you feel about your financial future can be replaced with confidence when you reclaim control.

What Financial Advisors Don't Want You to Know

Your suspicions about traditional financial advice are well-founded. When advisors push you to maximize investments in 401(k)s and IRAs, they rarely emphasize or even acknowledge how much control over your money you’re giving up - for decades. This outsourcing of control subjects you to rules and potential tax implications determined by others.

Similarly, when you seek safety and liquidity and are directed toward typical banks with their measly interest rates, you are forced into higher risk (money market accounts) or less liquidity (CDs).

The financial industry constantly bombards you with messaging that conditions you to accept building wealth through volatile markets as the only viable path. This creates an amnesia effect where more logical and controlled financial strategies are forgotten or dismissed.

Opting Out of Wall Street's Rigged Game

The financial elite have created a system that works brilliantly—for them. While they benefit from your "exposure" to market volatility, they've constructed safety nets for themselves that ordinary investors don't have access to.

But you don't have to play this game. There is a growing community of financially savvy individuals who have rejected the status quo and embraced strategies that prioritize control, guarantees, and sustainable growth.

Having guarantees in at least a part of your financial life allows you to take some risk in a more responsible fashion. Strategies like The Infinite Banking Concept (IBC) prioritize control of your capital and offer unparalleled guarantees and access to credit that provide liquidity.

Your dreams of financial independence are too important to be left to chance - or worse, to a system designed to benefit others at your expense.

StackedLife Podcast

Episode 8: High Risk with High Early Cash Value

I've noticed something concerning lately - the flood of “high early cash value” (sometimes called "90/10") whole life policies being promoted across social media, promising maximum early cash value with seemingly no downside.

In Episode 8, I show, in detail, that there is a downside. Hidden trade-offs that most agents never disclose. I compare data from two 50-year scenarios that show why these designs can cost policyholders hundreds of thousands or more in long-term wealth potential.

I'll demonstrate why “thinking long-range" is essential and how a more balanced policy approach provides the flexibility and wealth-building capacity that can transform financial outcomes for generations.

I’m John Perrings, Authorized Infinite Banking Practitioner and founder of StackedLife. Instead of taking high risk to get a high return, we help our clients implement strategies that create multiple safe returns with the same money. It’s geometric compounding that we call Stacked Interest Acceleration and IBC is the first step.

I’ve implemented IBC for hundreds of my clients and educated thousands more via my podcast, articles and courses at StackedLife.com.

Get my free mini-course, Adding Certainty to Supercharge Growth